Trusts’ initial reactions to their control totals

Our survey, conducted in February 2019, gives a specifically timed snapshot of trusts’ initial reaction to their control totals.

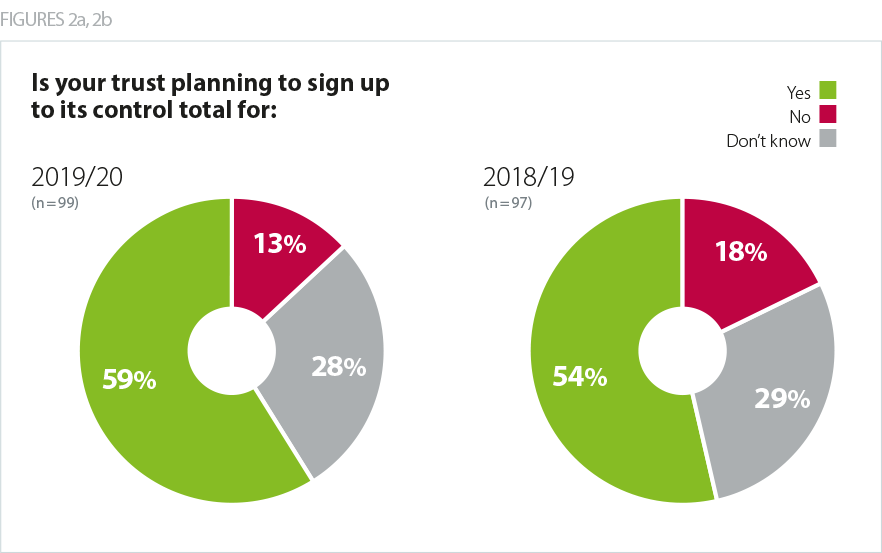

13% of respondents indicated in February 2019 that they would not sign up to their 2019/20 control total, while a further 28% said they did not know.

This compares favourably to the results of the survey conducted at the same point in 2018. In that survey, 18% of respondents said they would not sign their control totals, while a further 29% did not know.

In 2018/19 201 of the 227 providers (89%) actually ended up agreeing their control total. It is therefore reasonable to assume that more trusts will agree their control totals compared to last year. Feedback on progress since our February survey confirms this direction of travel and the latest information suggests that nearly all trusts will agree their 2019/20 control totals (in 2018/19 201 of the 227 trusts agreed their control total.

As clearly shown in recent years, there are strong incentives on providers (for example, access to PSF and capital) to agree their control totals, even if provider boards are concerned about their deliverability. A number of trusts have indicated that they believe the pressures on them to accept their 2019/20 control totals – the financial incentives and the overall positioning of the new financial architecture by the arms length bodies - have been greater than ever. While it is positive that the number of trusts agreeing to their control total will be significantly higher than last year, the number of trusts indicating in February they would be unable to accept injects an important note of caution.

As clearly shown in recent years, there are strong incentives on providers (for example, access to PSF and capital) to agree their control totals, even if provider boards are concerned about their deliverability.

tweet this

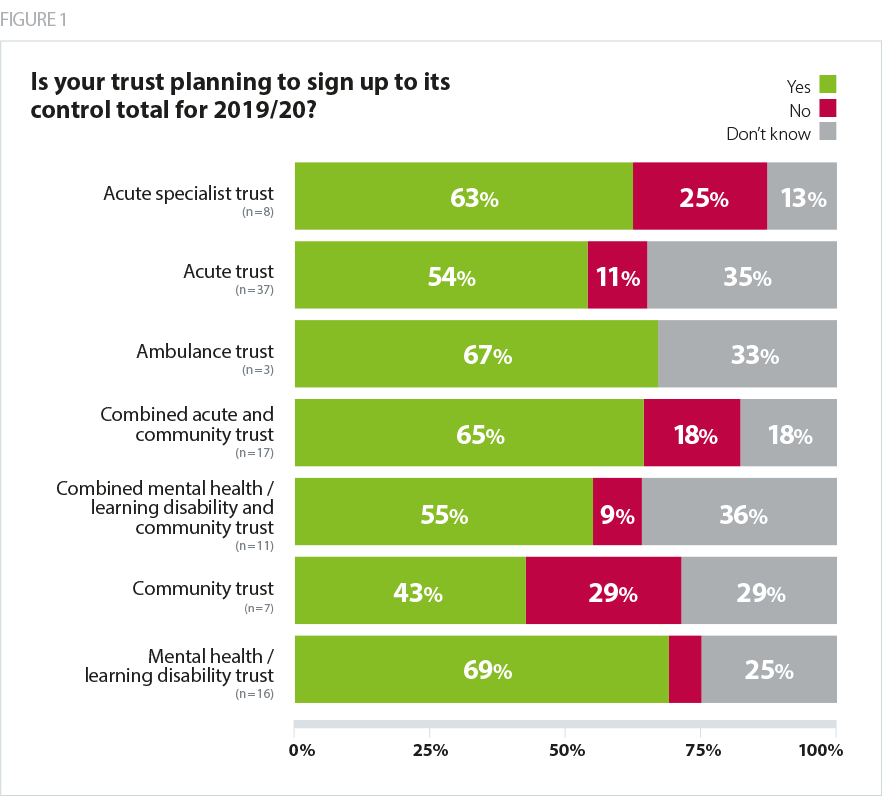

What has changed in our survey results this year, compared to last year, is how trusts in different sectors initially reacted to their control totals.

Community trusts

All community trusts that answered our February 2019 survey said they agreed their 2018/19 control total. However, for 2019/20, 29% of those trusts initially indicated they would not sign up to their control total – the highest rate in any sector.

A specific issue has arisen for community providers regarding public health services commissioned by councils: Agenda for Change staff delivering those services are due a pay rise but funding for local authorities has not been increased to fund them. While the Treasury has made money available to fund the three-year Agenda for Change pay deal agreed last year, this has been routed through the NHS tariff payment system from 2019/20 onwards. It is therefore unavailable to local authorities, even though NHS providers remain obliged to increase pay for all Agenda for Change staff. While all providers of community services are affected, the high rate of community trusts not agreeing to their control totals reflects the fact that these organisations are often the most exposed to this issue as local authority contracts tend to form a higher proportion of their income.

One survey respondent wrote: "Having initially felt positive, we now know that the pay award funding having been issued via CCG allocations will not find it way to Local Authority contracts held by the trust for Sexual Health and 0-19 services and this is a pressure for us."

Another said: "Currently there is no clarity of funding of NHS pay award for services commissioned by non-NHS commissioners e.g. Local Authorities. This is a £1.7m hit to my trust and if not funded it would not be possible to hit the control total. Adjusting the control total would not work as that would leave us with Income & Expenditure deficit before PSF which would lose credibility of the process with senior managers and also risk cash flow for investment in capital."

This problem has been discussed extensively with national level NHS system leaders with early indications that the problem would be resolved. A number of community trusts have recently told us that they have now accepted their control totals on that basis. However, the issue still remains unresolved, with a significant number of trusts with community services contracts therefore currently carrying a significant financial risk. A number of trusts, particularly a group of standalone community trusts, tell us that this risk represents the difference between being in financial surplus and deficit. If the NHS is to realise its clear, stated, objective of maximising the number of trusts in surplus, it is vital that the original government commitment to fully fund the agenda for change pay rise is met.

A specific issue has arisen for community providers regarding public health services commissioned by councils: Agenda for Change staff delivering those services are due a pay rise but funding for local authorities has not been increased to fund them.

Specialist trusts

A quarter of acute specialist trusts in our February 2019 survey indicated that they did not intend to agree their control totals: more than twice the rate of non-specialist acute trusts (11%).

Specialist trusts indicating in February 2019 they would be unable to sign up to their control totals cite changes to 'transition' funding – money which smooths the impact of decreases in 'top-up' payments for some types of activity. In 2019/20 this funding is reducing for three specialisms - paediatrics, orthopaedics and spinal cord injury services. Trusts that rely on these services for a significant proportion of their income stand to lose money in the coming year.

NHS Improvement have indicated that they have been working hard over the last two months to resolve these issues but, at mid April, trusts are indicating that the issues around the orthopaedic tariff remain unresolved. We believe that assurance is needed that all these issues have been properly resolved, with the relevant trusts having the opportunity to contribute to that assurance process.

NHS Improvement have indicated that they have been working hard over the last two months to resolve these issues but, at mid April, trusts are indicating that the issues around the orthopaedic tariff remain unresolved.

Control total perceptions

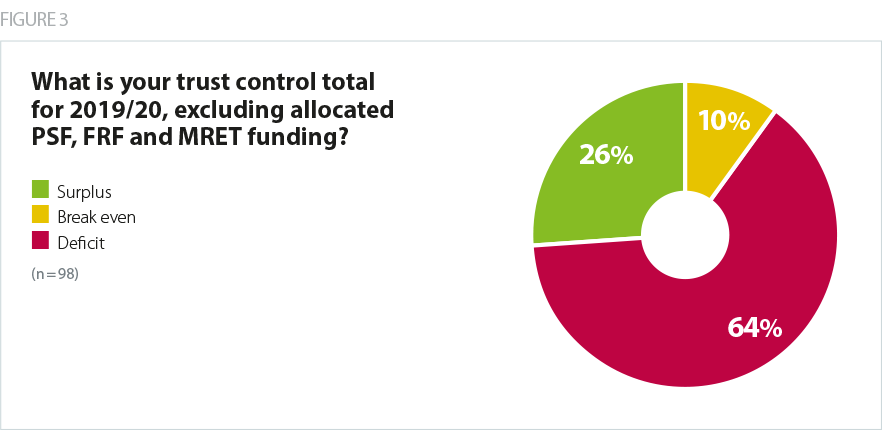

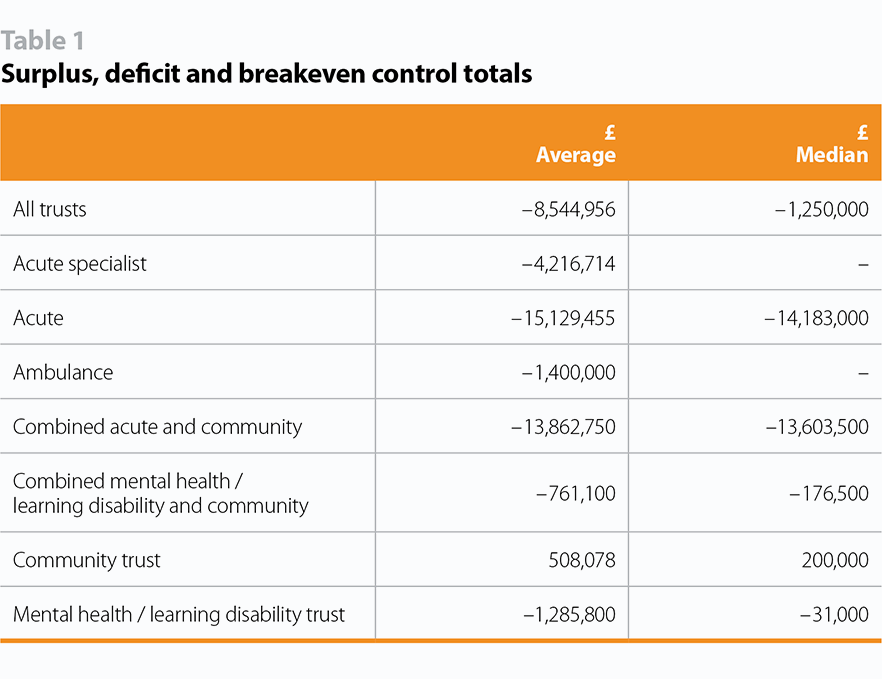

Our survey shows that nearly two thirds of control totals for 2019/20 are for deficit positions, before the allocation of non-recurrent funding such as PSF and the new FRF. Only a quarter are for a surplus.

Community is the only sector for which both the mean and the median average control total is for a surplus though, as outlined above, a significant proportion of community trusts initially indicated in February 2019 that they did not believe that their control total was deliverable. At February 2019, the acute, combined acute and community sectors were overall forecasting deficits significantly larger than the average. However, trusts and NHS Improvement have indicated that they have been working hard over the last two months to improve their forecast 2019/20 financial performance. This includes, for example, working with NHS Improvement and NHS England to ensure that CCGs have contracted with providers for appropriate amounts of activity in 2019/20. Trusts tell us that this work has borne fruit but, it is still to be seen whether trusts will actually be able to deliver the required task and their agreed plan as the year progresses.

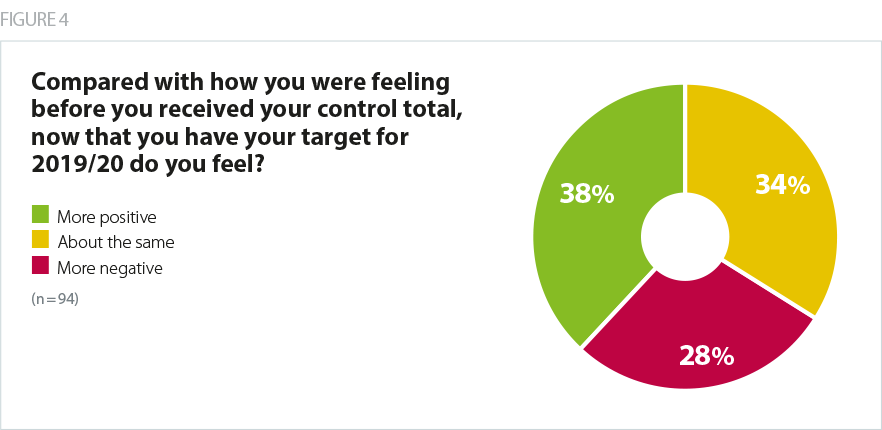

National system leaders expected the vast majority of trusts to react positively to what they believed would be 'more realistic and deliverable' control totals compared to previous years. We therefore added a new question to our survey this year asking whether trusts felt more positive or negative after receiving their control totals. 38% felt more positive and 28% of providers felt more negative. This suggests that whilst the overall reaction to the 2019/20 task was positive, there was still a significant minority whose initial reaction in February was that their control total was worse than they were expecting.

Confidence in delivering the required financial task

As the last few years have shown, agreeing a control total is different from actually delivering it. Despite best efforts, the financial pressures on providers have meant that provider financial performance has deteriorated against plan over each of the last few years. It is therefore important to assess how deliverable 2019/20 control totals will be.

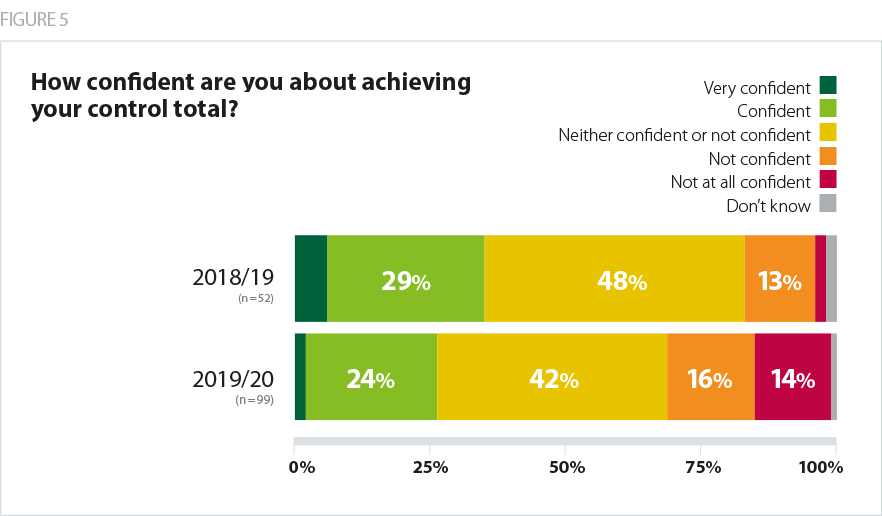

Our survey shows that, in February, a significant number of trusts had concerns that their control total would be stretching to deliver. 30% of providers were either ’not confident’ or ’not at all confident’ about hitting their 2019/20 control totals, while only 26% described themselves as 'very confident' or 'confident'.

It is interesting to note that this represents a drop in confidence compared to a year ago. In our 2018 control totals survey, 15% were 'not confident' or 'not at all confident', while 35% were 'very confident’ or 'fairly confident'.

Comments from trusts to our survey reflect an interesting diversity in reactions to 2019/20 control totals. One trust said NHS Improvement had taken a “more sensible approach” to setting their control total, which they described as “achievable, and starts from a more realistic baseline”. Similarly, another said there had been “recognition of current financial challenges… unlike previous years.” However, others noted that the “financial consequences of not accepting the control total are huge”, citing MRET and PSF incentives.

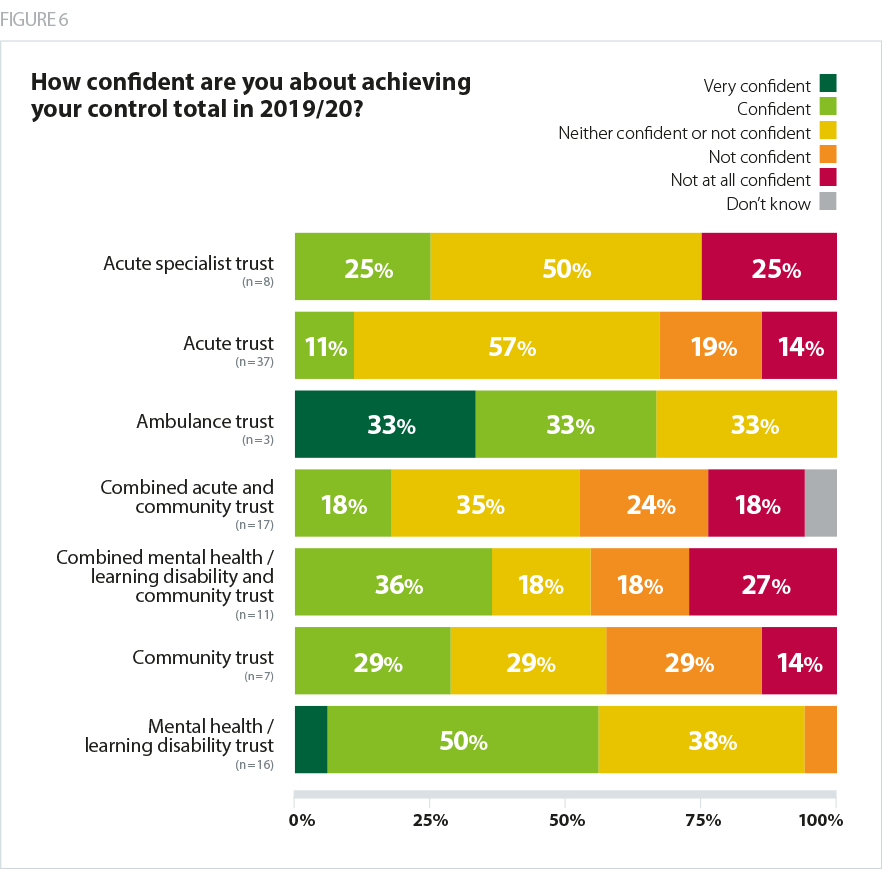

The sector with the lowest confidence in achieving their 2019/20 control totals, in our February snapshot, were providers of community services. On average, 30% of all trusts indicated that they were ’not confident’ or ’not at all confident’ of achieving their control total. This rose to 42% of combined acute and community trusts, 45% of combined mental health trusts and 43% of standalone community trusts. We believe this reflects the unfunded cost pressure relating to local authority funded Agenda for Change staff.

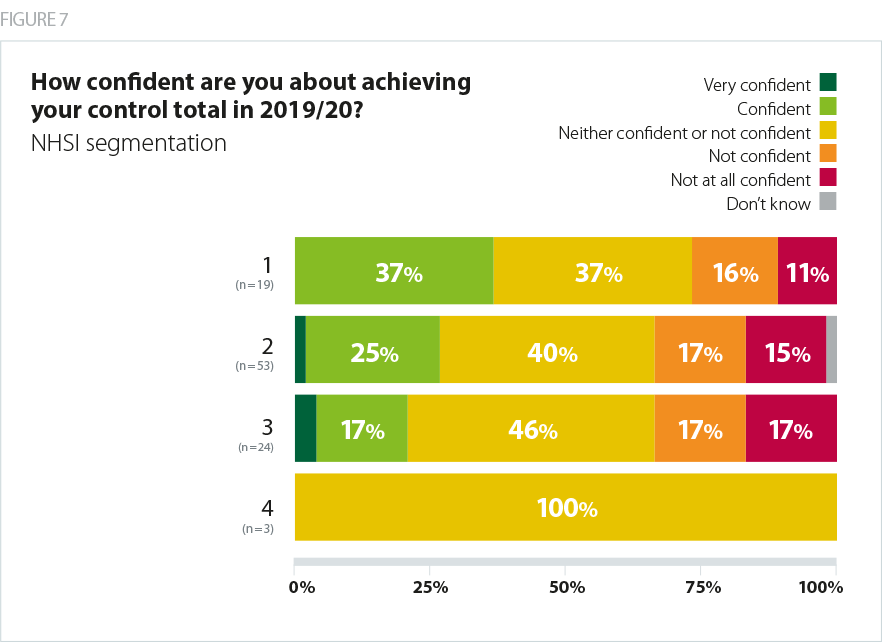

Trusts with the highest rating in NHS Improvement’s single outcomes framework (SOF) told us in February they were the most confident about delivering their control totals - 37% in segment 1, the highest rating, said they were 'confident' or 'very confident', while 27% were 'not confident' or 'not at all confident'. However, in segment 3, just 21% expressed confidence, while 34% were ‘not confident’. Of the three respondents in segment 4, all said they were 'neither confident nor not confident'.

Trusts expressed concerns over how their control totals had been calculated, with some arguing that the calculations were opaque and in need of clarification. Some providers were confused about which factors had been built into their control totals – for example whether Agenda for Change pressures or one-off income had been taken into account. Trusts have told us that, given the number of changes to the NHS financial architecture in 2019/20, many found the calculation difficult to understand. They tell us that their understanding has grown significantly over the last two months as the dialogue with NHS Improvement has deepened and this should be borne in mind when interpreting the results of our February ‘initial reactions’ survey.

Required levels of 2019/20 savings – the efficiency challenge

Trusts tend to measure the difficulty of their forward financial task through the level of CIP savings they need to make. Trusts’ forecasts of the levels of required CIP savings to realise their 2019/20 control totals are therefore another good indication of the potential deliverability of the overall 2019/20 financial task. Different trusts use different methods to calculate these savings but they can be a useful year-on-year comparison.

The core funding available to the NHS has risen for 2019/20 and changes have been made to the NHS financial architecture. As a result, the tariff payment system assumes an efficiency factor of 1.1% per year. This has been welcomed by the provider sector as the most realistic requirement for several years.

Some providers were confused about which factors had been built into their control totals – for example whether Agenda for Change pressures or one-off income had been taken into account. Trusts have told us that, given the number of changes to the NHS financial architecture in 2019/20, many found the calculation difficult to understand.

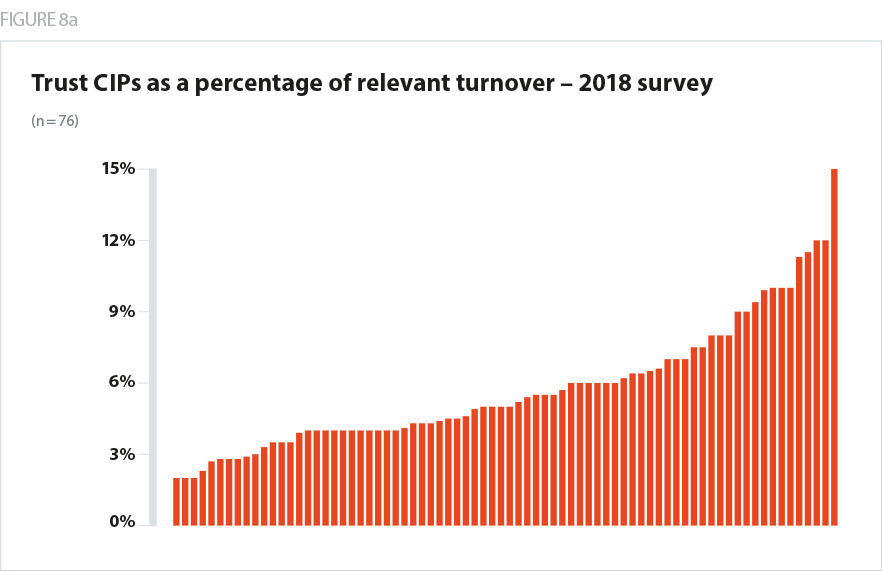

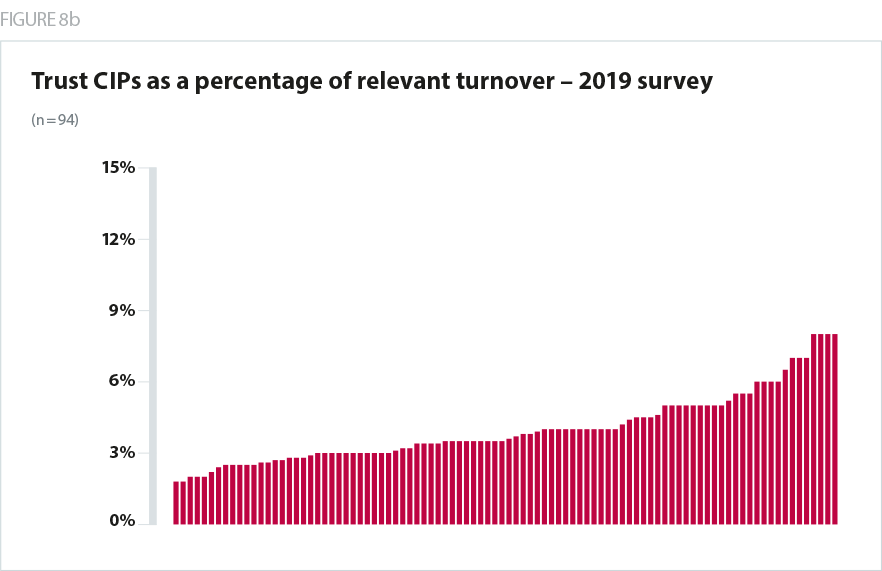

Our February survey found that the median cost improvement programme required as a percentage of turnover for 2019/20 will be 3.6%. This is comparable with delivery in recent years. The provider sector as a whole achieved savings worth 3.7% of turnover in 2017/18, although more than a third of the total were one-off, non-recurrent, savings rather than genuine efficiencies.

In 2018/19, at (Q3) trusts were forecasting 3.6% efficiency savings – with a slightly higher proportion of these being non-recurrent than the year before.

The overall CIP requirement for 2019/20 therefore feels to be at the upper end of what the service can reasonably be expected to deliver.

For some organisations, the efficiency challenge looks extremely challenging. Half of those who completed our survey have CIPs that are higher than the average rate of delivery for the sector as a whole in 2018/19. Additionally, there are still some trusts with very high CIP challenges - 12% of providers have a CIP of over 6% of turnover. Four trusts told us their CIP would be 8%.

The overall CIP requirement for 2019/20 therefore feels to be at the upper end of what the service can reasonably be expected to deliver.

This is, however, also a major improvement on 2018/19. In our survey a year ago, the median reported CIP was 5%. 15% of trusts faced a CIP of more than 8%.

At the other end of the scale, 21% of trusts say their 2019/20 CIP will be below 3%. A year ago, it was just 12%.

Overall, therefore, the efficiency challenge in 2019/20 looks to be less severe and more realistic than the past two years. As a whole, it is in line with the current levels of actual delivery. However, while CIPs are on average more realistic, the change is less dramatic than many will have expected, given the 1.1% efficiency factor in the tariff, and the large uplift in overall NHS funding. There will inevitably be trusts whose CIPs are high –and for some of these organisations the efficiency challenge will still appear very difficult and challenging.

This will be particularly true for trusts with deficit control totals wishing to access FRF, as one of the conditions attached to the fund is to deliver an additional 0.5% efficiency. A fifth of trusts felt either ’not confident‘ or ’not at all confident‘ that they could deliver the extra efficiency needed to access FRF. As CIP delivery is essential to a trust hitting its control total, the stretching efficiency requirements facing trusts in 2019/20 may be a factor driving some of the low levels of confidence described earlier.

Overall, therefore, the efficiency challenge in 2019/20 looks to be less severe and more realistic than the past two years. As a whole, it is in line with the current levels of actual delivery.

Explaining variability

A key underlying theme of our survey was that the financial task facing trusts was not universally ‘better and more realistic than previous years’ in the way trusts had expected, given how the 2019/20 financial framework had initially been positioned by national system leaders.

As the survey results above show, it was striking that while the positive impact of the extra funding and the architecture changes was definitely being felt across the sector, there was considerable variability in trusts’ reactions to their control totals.

The survey found that trusts in the same category– for example large combined mental health and community trusts, or medium sized district general hospitals – have not necessarily reacted to their control totals in the same way. The measures taken at a national level to support the provider sector have not had the same positive impact everywhere. This is unusual, in our experience. Changes to the financial framework tend to impact similar types of trust in a similar way.

There is currently a lively debate in the sector around the reasons for this variability. NHS Improvement has indicated to us that they believe that most of this variability is due to provider failure to realise appropriate levels of 2018/19 recurrent savings, with a consequent impact on 2019/20 run rate.

The measures taken at a national level to support the provider sector have not had the same positive impact everywhere.

Trusts tell us that an alternative explanation is the aggregate impact of a number of different micro factors is affecting trusts in different ways. These micro factors include:

- Some trusts have told us that the overall increase in funding is not enough to mitigate changes to the market forces factor (MFF) in the tariff.

- Providers have also reported commissioners proposing to increase contract values by less than the uplift they will receive – effectively not passing on the funding rise to providers. Providers also report that some CCGs under financial pressure are not commissioning realistic amounts of provider activity in 2019/20 as a way of managing their financial challenge. It is worth noting that there have been some significant changes to CCG allocations in 2019/20 as part of a longer-term strategy to align funding better with health need.

- Changes to the urgent and emergency care tariff will also leave acute trusts with a shortfall in income if they cannot agree a realistic forecast of emergency activity with their clinical commissioning groups.

- Some trusts have a grade mix with a larger than average proportion of their workforce in the pay bands that, in 2019/20, benefit most from the Agenda for Change pay deal agreed last year. This means that their pay costs will increase by more than the average assumed in the tariff.

As we suggest in our section on recommended actions below, we believe more work is needed to understand this variability.

Some trusts have told us that the overall increase in funding is not enough to mitigate changes to the market forces factor (MFF) in the tariff.

System control totals

The NHS long term plan emphasises a move towards system working. It introduces a new expectation that all trusts will be part of integrated care systems, with advanced levels of collaboration and joint accountability, by 2021. The credibility of system control totals – which cover a group of providers and commissioners in a wider health and care system – is therefore becoming increasingly important.

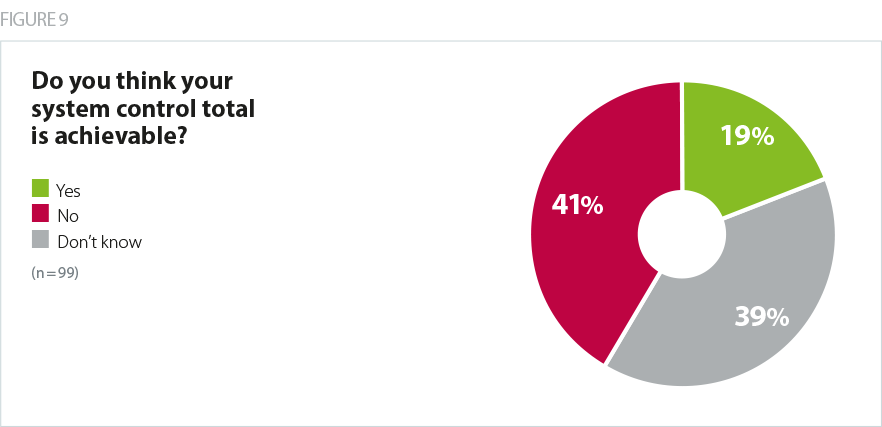

Our survey showed that, in February, less than a fifth of trusts believed their system control total was achievable, while two fifths believed it was not. A high proportion however, 39%, did not know. Trust leaders were, therefore, more likely to believe their own organisation’s control total was achievable than their system control total. This possibly reflects the varying degrees of maturity in system working across the country: most areas are not yet capable of an advanced level of collaboration and therefore only a minority have integrated care system status.

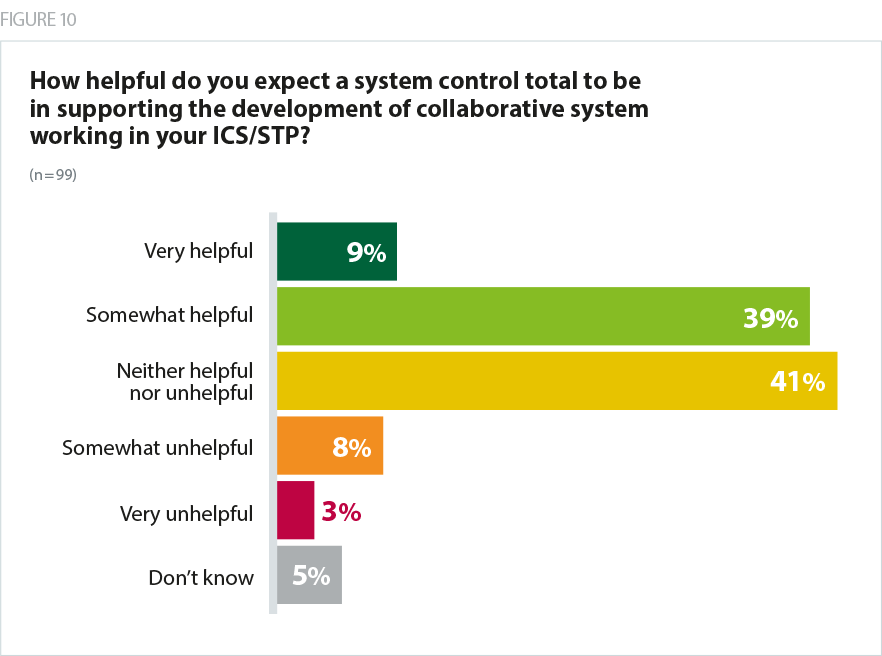

However, despite being sceptical that system control totals will be achievable, trusts tended to believe they are helpful in encouraging collaborative system working. More than half said they were 'very helpful' or 'somewhat helpful', compared with just 11% who said they were 'somewhat unhelpful' or 'very unhelpful'.

Several trusts expressed doubts that system incentives would trump the need to deliver an individual organisation’s financial requirements.

One trust commented: "System control totals whilst we still have a provider/commissioner split and organisation-level regulation do not solve the problem – the first thing the system would need to do would be to agree what each organisation needs to deliver in order to meet the system control total, which is no further forward than we are now… telling everyone to forget about their individual budgets and just focus on achieving the overall financial target of the organisation would lead to loss of, rather than improved, financial performance and control".