Trusts understand the need to return to 'business as usual' financial arrangements post pandemic. However, the 2022/23 financial year presents a major challenge for trusts. There are now multifactorial cost pressures making it increasingly challenging for trusts to meet the financial ask of increasing activity in the context of a stretching efficiency target.

To what extent are 2022/23 allocations sufficient to meet the financial ask?

Inflationary pressure

- The majority of trusts agree that revenue allocations for this financial year present a demanding financial ask, with 95% of respondents saying the 2022/23 financial task will be 'difficult' or 'extremely difficult'.

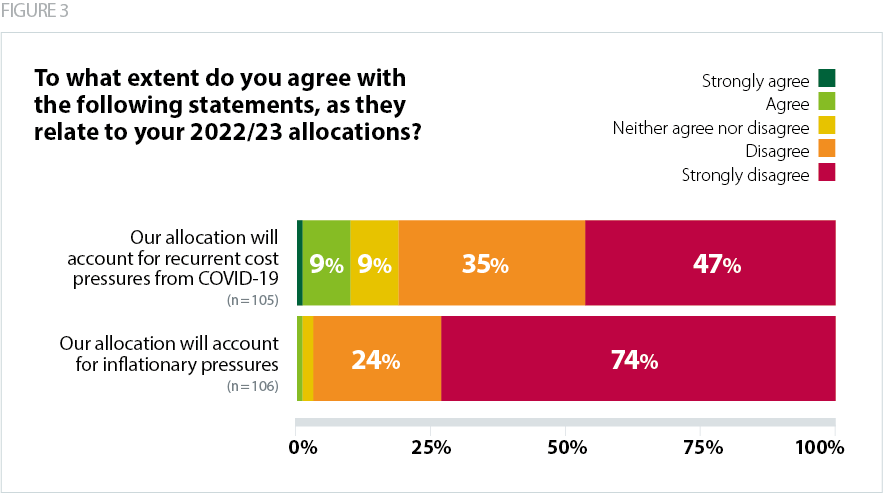

Increases in inflation are being felt across the economy. This widespread inflationary pressure is likely to erode the SR21 cash settlement for the NHS, and trusts are concerned that this year's system revenue allocations will not cover the increasing costs they will face as a result.*

*[This survey was carried before the recent announcement from NHSE on 19 May about the additional £1.5bn funding injection.]

Trusts are concerned about the impact of significant rises for energy and fuel prices in 2022/23. Inflationary pressures on NHS partners are also being reflected in contracts and loans. For example, some trusts have told us that independent sector organisations managing placements for mental health and learning disability patients are requesting uplifts commensurate with inflation. Additional cost pressures are also emerging from inflation across private finance initiative repayments.

The recent NHSE announcement of an additional £1.5bn to mitigate excess inflation has therefore been welcomed by trust leaders. However, this funding injection is not an additional uplift on top of the existing NHS settlement and will instead involve redirecting funding from elsewhere across NHSE's budget. This will help offset inflationary pressures, but it is not yet clear whether this will have a material impact on the overall efficiency ask of the provider sector, and whether it will be enough to offset the gap in the financial plans of some trusts and integrated care systems (ICSs).

Withdrawal of COVID-19 funding

- 82% 'disagree' or 'strongly disagree' that their allocation accounts for recurrent COVID-19 cost pressures.

In line with the SR21 settlement, the NHS is expected to reduce direct and indirect COVID-19 costs. COVID-19 funding allocated to integrated care boards (ICBs) will fall radically by 57% in 2022/23 compared to 2020/21. As COVID-related operational pressures recede and the service is better able to mitigate against disruption to services, the provider sector expected that the size of the quantum in 22/23 would fall.

However, several respondents to our survey described caring for double or triple the number of COVID-19 positive patients in hospital compared to the first wave of the pandemic. Despite aggregate cases coming down and severity reducing on average, there are pockets of COVID-19 pressures in England which impact trusts in certain locations.

Trust leaders are concerned that the extent of the fall in COVID-19 funding in 22/23 will not enable them to meet additional in-year cost pressures caused by current and potential winter levels of COVID-19 activity and the associated disruptions for non-COVID-19 activity.

Budget allocations for pay

- The vast majority of respondents (94%) are not confident that they would have sufficient revenue funding for any additional pay costs if pay review bodies' recommendations exceed current budgeted allocations.

Trust leaders know how hard their staff have worked throughout the pandemic and are mindful of how rising inflation and costs of living are negatively impacting the NHS workforce. Provider leaders believe a meaningful pay award is critical to support staff recruitment and retention this year but they are also clear that this must be adequately and appropriately funded.* An NHS Providers survey – conducted in December 2021, prior to the more recent significant rises in the cost of living – indicated the majority of trusts support a pay award: a large proportion of respondents (28%) supported an uplift of 5% of more. Indeed, the government's proposed 2-3% rise in 22/23 would represent a significant real-terms pay cut, if implemented, given the consumer prices index (CPI) increased by 9% in the 12 months to April 2022.

*[The long-term plan implementation framework from 2019 accounted for an uplift of 2.1% in 22/23. In its recent written evidence to PRB, DHSC proposed a 2-3% pay award for AfC staff. This is comprised of a 2% ‘assumed headline’ award within DHSC's set budget, with an additional 1% "contingency" which, if used for staff pay, "means that this contingency will not be available for other priorities". Department of Health and Social Care, The Department of Health and Social Care’s written evidence to the NHS Pay Review Body (NHSPRB) for the 2022 to 2023 pay round, February 2022]

Our survey results indicate that trust leaders are concerned that any shortfall resulting from a partially funded pay uplift would mean reducing the provision of some services to live within budgeted allocations. Other respondents told us they have built in assumptions that if the final pay award is higher than the planning guidance suggested, additional funding will be provided to mitigate against any increased costs.

If the upcoming staff pay award exceeds the allocation already built into the annual uplift, trusts must be given immediate assurances that additional costs will be centrally funded.

Elective recovery funding

In 2022/23, ICBs will be able to earn additional funding via the elective recovery fund (ERF) if they deliver 104% of 2019/20 levels of elective activity.* However, there is a concern among acute trusts that they will not recoup the additional funding allocated in SR21 for elective activity if they underdeliver against the target.**

*[This includes activity across elective ordinary, day case and outpatient procedures.]

**[Trusts that exceed the 104% target will receive additional funding (at 75% of national tariff prices) while providers who fall below this threshold will have the funding recouped (also at 75% of the tariff).]

Trusts are concerned about how they can mitigate the additional costs incurred if they underdeliver against activity targets. As highlighted in the previous section, given that many providers are not projecting to deliver at 104% in 2022/23, this could mean much needed funding will be taken out of their baselines, and away from patient care, due to tariff penalties.

Financial balance of providers and systems

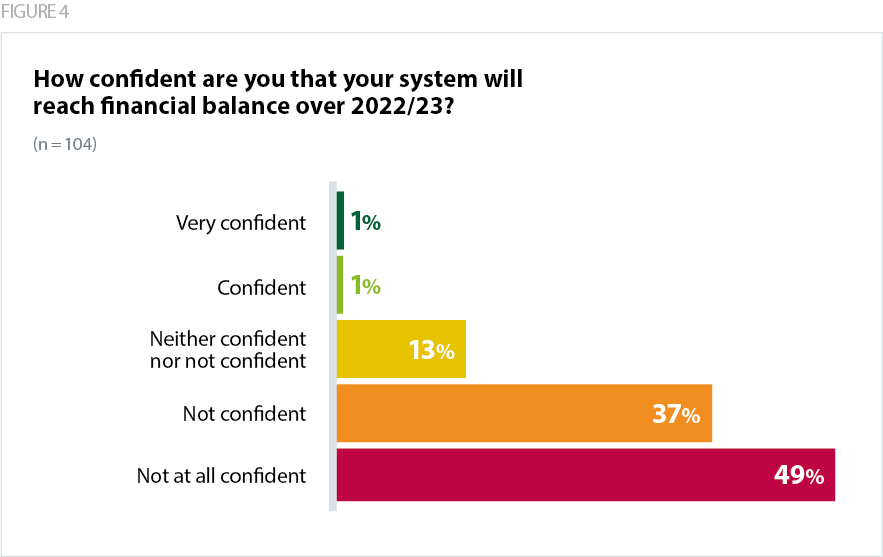

- Of the trusts that responded to our survey, 85% said they are not confident or not at all confident that their system will reach financial balance over 2022/23 and we have been told by some ICBs that they have submitted system plans that will not break even.

- At the provider level, over 90% said they are 'not confident' or 'not at all confident' that their trust will end 2022/23 in a better financial position than it ended 2021/22.

The emerging cost pressures highlighted above will make it more challenging for trusts and systems to reach financial balance. There is concern among some trusts that in order to reach a breakeven position they will need to restrict recovery and service delivery, missing the ambitious targets they are striving for or diminishing the quality of patient care.

Capital funding

Backlog maintenance and operational capital

- 68% of respondents are not confident that they will be able to sufficiently address the backlog within existing operational envelopes.

The capital maintenance backlog remains a major concern for trusts. At this stage of the planning process, early in the financial year, there are concerns about the adequacy of system capital envelopes to address key operational repairs and enable trusts to manage risks to staff and patient safety.

Trusts are telling us that the limited headroom within system capital envelopes means they carry high levels of risk related to their infrastructure and estates on a day-to-day basis. Without appropriate investment, issues like leaking roofs and broken boilers, ligature points in mental health facilities and outdated technology cannot be fully addressed, compromising both quality of care and patient safety.

Focus of national capital allocations for providers

- 65% of respondents are not confident that they will be able to expand capacity to deliver an increase in non-elective activity.

Our survey found some providers are concerned that the national priority for elective recovery means that there is a corresponding underinvestment in ambulance, mental health and community services. This is a particular challenge for those trusts aiming to redevelop and improve facilities which serve a population broader than an individual ICS. Respondents also highlighted the need for more clarity and greater flexibility on capital spending for their trusts and services.