To better understand the impact of the current capital system on frontline services, we surveyed finance directors from 16 June to 15 July 2021. The survey received responses from finance directors across 58 trusts, representing 27% of the provider sector. All regions and trust types were represented in the survey. Key themes are summarised below (access to capital, freedom over capital spending and the benefits of capital investment).

Access to capital

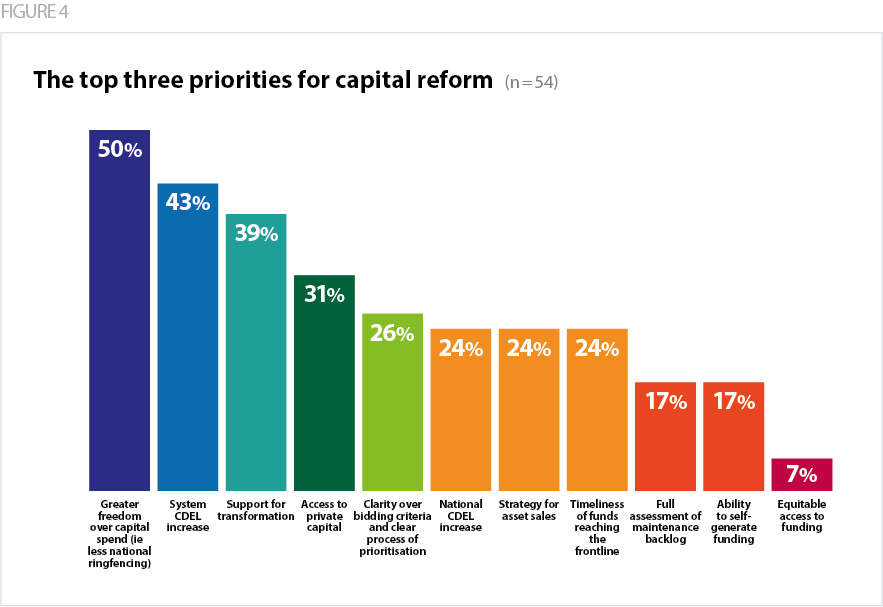

It is well established that current levels of capital spending are insufficient to meet the NHS' needs (NHS Providers, 2020). This was reflected in the feedback we received from trusts. When asked about access to capital funding over the next three years:

- 78% of trusts felt "very unconfident" or "unconfident" that they would have access to sufficient capital funding to transform in line with the ambitions of the NHS long term plan

- 67% of trusts felt "very unconfident" or "unconfident" that they would have access to sufficient capital funding to address their total maintenance backlog

- 67% of trusts felt "very unconfident" or "unconfident" that they would have access to sufficient capital funding to transform as part of the journey to digital maturity.

Respondents specifically mentioned that national and system capital limits were insufficient to improve digital infrastructure, reduce the maintenance backlog and fulfil the ambitions of the long term plan.

"The level of capital that is going to be required in the future for digital changes totally outstrips the envelope that can realistically be allocated to digital after ensuring high risk backlog areas are addressed".

Acute and community trust

"We see no prospect of maintaining our five-year plan."

Acute trust

Respondents also flagged a lack of middle size capital funding, and concerns about how historical private finance initiative (PFI) deals impacted their ability to access capital funding.

"There is currently no national direction of middle size capital funding. Integrated care system (ICS) allocations arguably fund backlog maintenance and small projects to maintain the status quo of service delivery and at the other end of the financial spectrum there is the hospital improvement programme large scale developments. There is currently a void with regards to say £20m-£70m projects, that fall in between, but for which there are a large number. In our ICS there are several in this category without a clear funding plan identified."

Combined acute and community trust

"The capital regime is based on internally generated depreciation. As a provider with a large PFI debt this is significantly limiting the level of capital funding the system can access and directly limiting the future investment."

Acute trust

Respondents specifically mentioned that national and system capital limits were insufficient to improve digital infrastructure, reduce the maintenance backlog and fulfil the ambitions of the long term plan.

Freedom over capital spending

National/System limits

- Trusts have long had to stay within the DHSC’s national capital departmental expenditure limit (CDEL). NHS England and NHS Improvement then introduced a new approach to capital funding in 2020/21, breaking the total capital available nationally into individual system-level limits within which providers have to work together to prioritise spending.

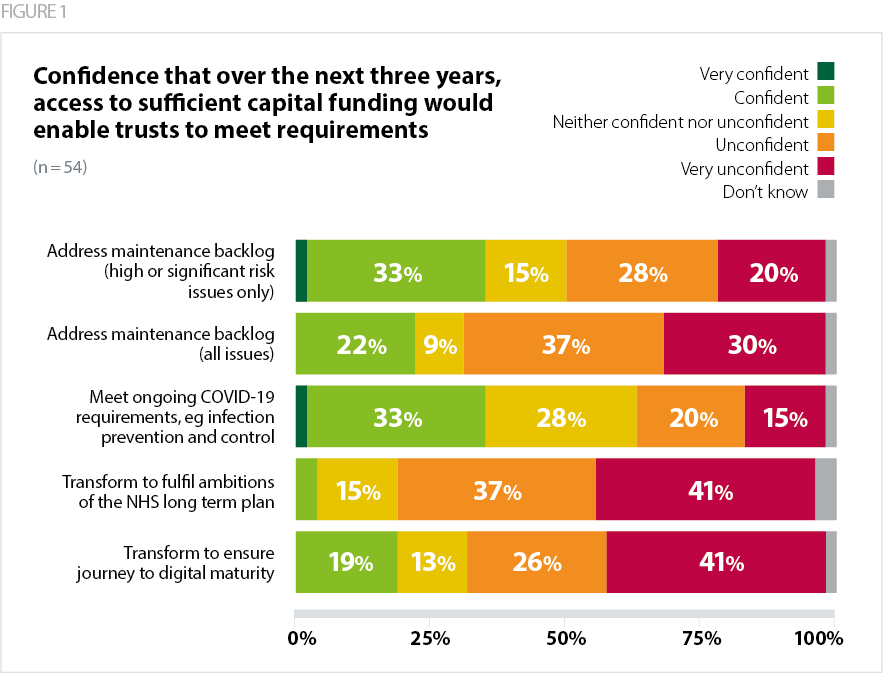

- Trusts understand, and generally accept, the rationale for system capital envelopes. However, they also reported that both national and system capital limits significantly hinder their ability to invest in their estates. 67% of trusts “agreed” or “strongly agreed” that they had funds to invest in capital projects, but national/system capital limits restricted their ability to do so.

Trusts that "agreed" or "strongly agreed" said that they had cash to fund their capital projects (some with significant funds) but were restricted by the CDEL. One acute trust in the south west told us that they had to cut their capital programme by 20% in 2021/22 to stay within their system CDEL, even though they had the funds to spend. This ultimately meant that investment in extra capacity and reconfiguration for recovery of services was reduced. Furthermore, the trust was unable to pursue accommodation for overseas staff, making it much more difficult to resolve significant staffing pressures at a time when the need for staff has never been greater.

"We have cash which has been built up over a number of years to fund capital developments. We are now in danger of not being able to implement our estates strategy due to insufficient capital resource limit."

Community trust

National ringfencing

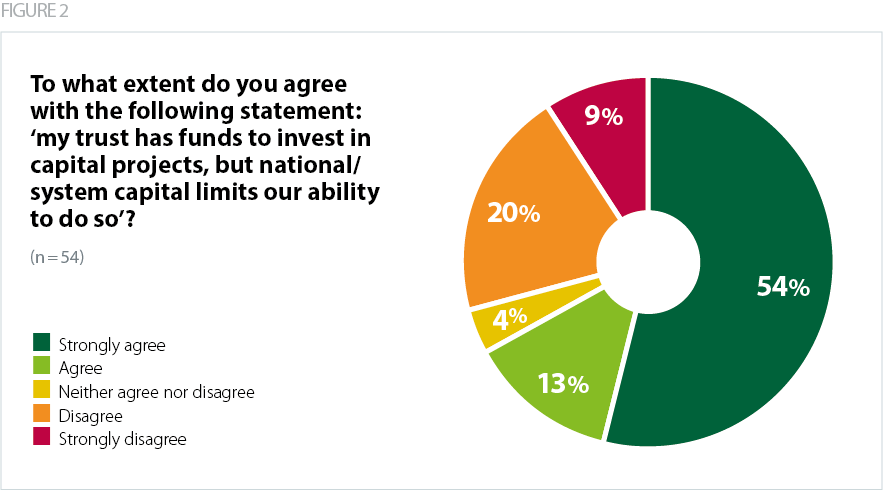

Some trusts mentioned that there was a benefit of being part of the hospital building programme, otherwise you could be overlooked for capital funding. However, the majority of trusts did not agree that the government had appropriately divided capital funding between day-to-day needs and national programmes, saying too much focus was on national programmes. 15% of trusts agreed that the government had appropriately divided capital funding between day-to-day needs and national programmes, while 30% of trusts did not know. Another acute trust told us that the funding allocated to build 40 new hospitals was "grossly insufficient".

"The fragmented way capital is allocated between system capital and national initiatives also does not help plan transformation and leads to a postcode lottery"

Community trust

The benefits of capital investment

- Trusts told us that if they had sufficient capital funding, it would allow them to reduce their maintenance backlog, improve their estate (modernise, improve efficiency, and reduce their carbon footprint) and invest in digital infrastructure. One acute trust told us that capital investment would allow them to make further improvements in patient experience and reduce IPC risks, for example increased bathroom facilities on wards, investment in respiratory ward infrastructure to support an increase in patients requiring non-invasive ventilation (NIV) and high-flow care, which reduces time in intensive care.

- Trusts also said that sufficient funding will allow them to expand wards and service capacity, reduce waiting lists and improve pathways. Given that waiting lists are at an all-time high due to the backlog of care created by the pandemic, it is imperative that trusts are financially supported to tackle these waiting lists through effective means like increased physical capacity and service expansion. While the government’s September 2021 announcement of £500m capital funding for increased theatre capacity and technology will make a start on tackling backlogs, recurrent funding will be needed.

- Respondents said that their top investment priorities in their digital portfolio included server infrastructure replacement, electronic patient records, electronic prescribing and medicines administration , implementing cloud storage, cyber security, shared patient records, automatic scheduling and rostering and a paperless documentation system. Some trusts also mentioned improved business intelligence, investment in mobile working and investment in various clinical pathway software and robotic tools.

- The benefits of digital transformation are well documented, from improved clinical outcomes to efficiency savings. The scale and speed of digital innovation seen during the COVID-19 pandemic has been impressive and shown how adaptable and innovative the NHS can be in the face of unprecedented pressures. With the right capital and revenue investment, trusts will be able to build on this to truly transform services in line with the needs of patients, service users and carers.

Respondents highlighted the positive impact that a properly funded and well-designed system of capital funding can have. Examples include:

"A clear strategy and access to cash has meant our trust has delivered some significant strategic and operational patient benefit - for example we have recently built a new primary care centre on our site. We have created a children's emergency care unit, a co-located urgent treatment centre, there is so much more we could do with proper access to funding."

Combined acute and community trust

"The ambulance sector needs both revenue and capital for transformation. The outcomes for (our trust) would be potentially in excess of 10% further reduction in ED conveyances and an efficiency potential of c£30m per annum by five years i.e. 5% efficiency."

Ambulance trust

"We would be able to fully meet our backlog maintenance requirements, while moving forward with a transformational estate development which greatly improves patient access and experience whilst providing a modern efficient health campus and develop our digital programme at the pace required to enable our staff to be productive and therefore increase throughput in services with built up waiting list".

Community trust

"[sufficient capital funding] would allow us to further develop our plans for integrated community hubs across the county which would allow us to rationalise local public sector buildings and bring services together to provide integrated care".

Community trust

"Further improvements on patient experience and reduced IPC risks - i.e. increased bathroom facilities on wards. Investment in respiratory ward infrastructure to support an increase in patients requiring NIV and high flow care which reduces time on intensive care. Accelerate digital strategy and move to paper free records to reduce risks, improve IPC and increase efficiency."

Acute trust

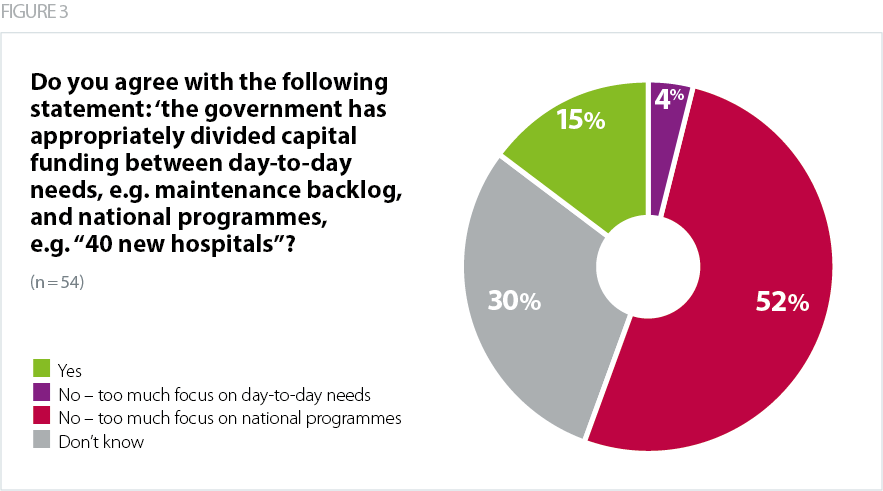

The top three priorities for capital reform

- 50% of trusts said greater freedom over capital spend

- 43% said a system CDEL increase should be a top priority

- 39% said support for transformation should be a top priority.